European Mobile: The Future’s not Bright, it’s Brutal

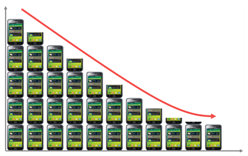

New analysis by the Telco 2.0 team shows that the mobile industry’s combined revenues from voice, messaging and data services in the EU5 economies (UK, France, Germany, Spain and Italy) will drop by nearly 20Bn Euros, or 4% per year, in the next five years, and by 30Bn Euros by 2020. (October 2012, Executive Briefing Service)

Euro Voice Brutal Future October 2012