Disaggregation of the telco industry and value chain: What does this mean and look like?

The increasing shift to cloud native and disaggregation of telco networks opens up the telecoms landscape to new types of players in both the infrastructure and software layers that impact the nature of telcos’ business model and role within the ecosystem. In the first part of this article series, we explore the shift towards disaggregation in the industry and what’s driving it.

What do we mean by telco disaggregation?

Disaggregation means separating out the processes, services and functions of technology, the economy and society and recombining or coordinating them to better meet changing needs. In our ‘Why and how to go telco cloud native: AT&T, DISH and Rakuten’ report, we define telco disaggregation as the breaking up of telecoms technology, organisations, value chains and processes into their component parts and re-engineered. This could mean separating out network functions (from their underlying hardware but also into their component parts), changing organisational structures, or changing what it means to be a telco with new business models.

Disaggregation can manifest in three different aspects of the telco business:

- Technology

- Organisational structure and operating model

- Value chain and business model

Why now?

The telecoms industry is undergoing the process of ‘computerisation’, i.e. digitisation, softwarisation, virtualisation (NFV) and cloudification. The ‘telco disaggregation’ is inherently part of this evolution. With the breaking up of processes, systems and functions, this means that telcos are facing increasing competition from new types of players across different areas of the value chain. New types of telecoms service providers are starting to emerge in a huge variety of different shapes, sizes and backgrounds. Therefore, the overall competitive landscape can include players such as:

- Computing, IT and cloud players

- More specialist and agile network providers

- And vertical-specific actors that deliver connectivity services to vertical-specific applications.

We explore this in more detail in our ‘The new telcos: A field guide’ report.

Why it matters: Opportunity or threat?

Connectivity services are increasingly becoming commoditised. Though telcos are continuing to invest in improving the connectivity services they provide to customers, they are effectively competing in saturated markets where it tends to be difficult to differentiate their propositions and maintain revenue growth. In some markets, growth is even stagnating. Value is shifting to the services that run on top of the network, which introduces a host of new types of competition (including the big internet players) but this is also ultimately where telcos should also invest.

At the same time, as telco networks are being softwarised, virtualised and cloudified, networks are also moving from static, monolithic architectures to becoming more open, disaggregated and flexible. This means that networks are also becoming increasingly visible, programmable and ‘instructible’, which opens up new opportunities to innovate and leverage network intelligence to enable better application outcomes.

However, given that competitive threats are coming from multiple directions, which puts telcos at risk of being relegated to connectivity providers, telcos need to be able to innovate in a much more agile way than they have been able to before in order to compete against new competitors. Telco disaggregation can help separate and unlock very different operating and business models, which can fundamentally allow telecoms operators to address key opportunities without one part of the business impacting the ability of another to innovate.

In our next few articles, we will dive into different operator case studies in the context of technological, organisational and business model disaggregation. Within these dimensions of disaggregation, we will also explore the following questions:

- Which part of the value chain should telcos focus on?

- What roles can and should telcos play?

- How will this impact the telco business? (e.g. telco financials, core IP etc.)

Network APIs: Unlocking new value in the telco cloud

Network APIs may offer an answer to the question of how to monetise recent and upcoming telco cloud deployments. Virtualised networks upgrade APIs and enhance the value they offer to developers and customers. To unlock their potential, telcos should focus on optimising their commercial models.

Progress in telco cloud: How do we measure agility?

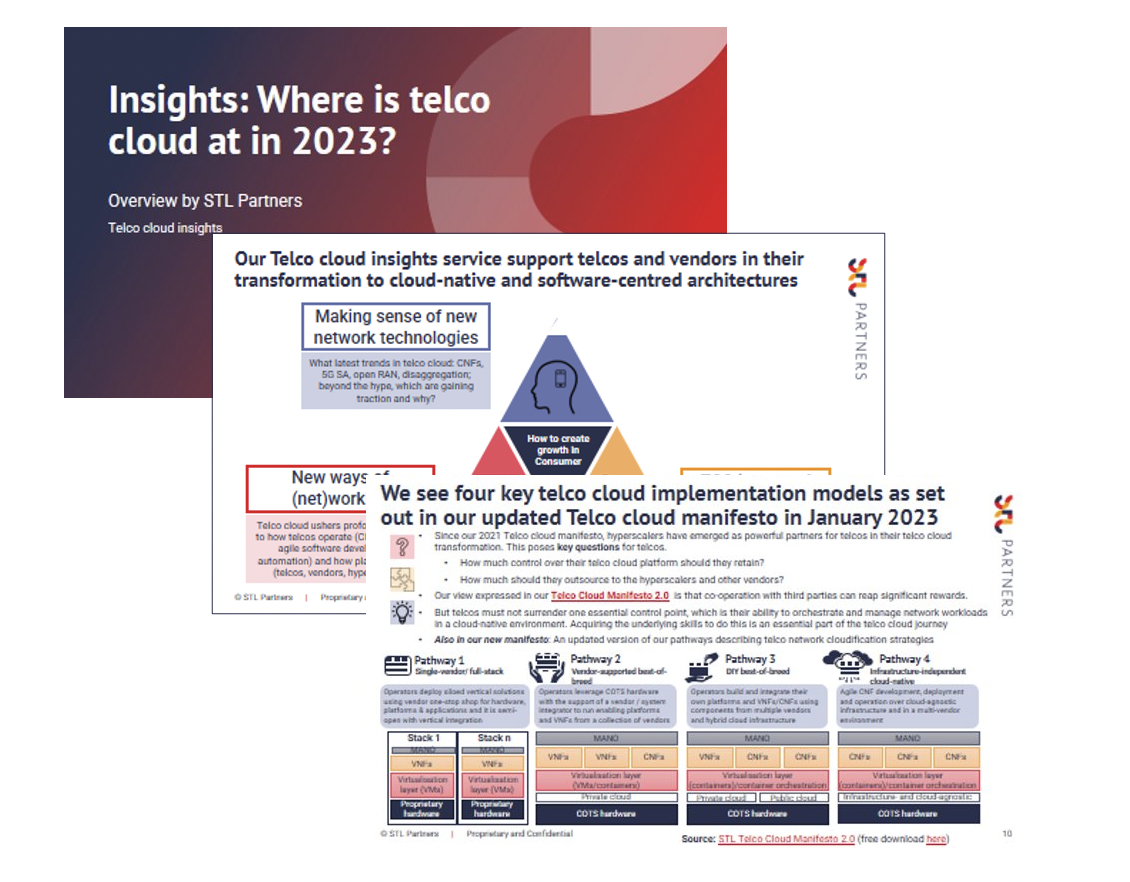

In the January 2023 update to our Telco Cloud Deployment Tracker, which was looking back at the entirety of calendar year 2022, we recorded an overall slowdown in deployments.

Network Innovation insights pack

This document will provide you with the latest insights from our research and consulting work, including some extract of our Telco Cloud Manifesto 2.0, our latest analysis on open RAN.