Automation in the telecoms industry: A key differentiator

AI and automation are becoming increasingly important to telco strategies as they seek to handle new network complexities and address revenue decline. This article explores how telcos are thinking about automation, and why they should think about moving from intra-process automation in the short term, to inter-process automation in the longer term.

Automation will be a key pillar for telcos to achieve competitive differentiation in an increasingly saturated market. Whether their focus is on providing exceptional connectivity, or they are seeking to offer new solutions beyond connectivity, telcos will need to introduce more automation into their network and service operations to address shrinking revenues from network commoditisation.

STL Partners recently surveyed more than 100 key individuals from telecoms operators globally to understand how telcos are pursuing automation and defining their strategies. Based on this, and interviews with 15 leading operators, we produced a set of recommendations for telcos in defining their automation strategies. Our report ‘Prioritising automation: Creating a successful building block strategy’ summarises our key findings and looks at the following aspects:

- How automation, AI and data analytics are driving telco strategies

- How telcos can create a building block strategy to succeed with automation

- How telcos can begin to innovate with automation, from people & culture to systems & technology

Why do telcos need automation?

70% of our survey respondents stated that they intended to move beyond providing basic connectivity and were seeking new opportunities for revenue growth. Increasingly, telcos are seeking to exploit emerging technologies such as 5G and edge computing to offer differentiated solutions to customers, particularly in the B2B2X space. However, network and service automation will be a key enabler for all telcos to address declining revenue growth, regardless of their strategic approach.

Figure 1: Automation will be critical for telcos whether they are focusing on connectivity, or exploring new avenues for revenue growth

AI/ML-based automation is much more nascent (mostly at POC stage) for telcos than rules-based automation which has long been part of network processes. However, as outlined in our previous research, STL Partners views telco automation journeys as a continuum, wherein telcos should gradually transition from rules-based (business intelligence and fixed-policy automation), to ML-supported automation and ultimately fully autonomous systems that include self-improving and self-learning capabilities.

In order to provide strong connectivity, manage increasing network complexities (with 5G), and maintain cost efficiencies, telcos will need to define a roadmap for how they can introduce more automation into their network and service operations. For telcos seeking to exploit new technologies, more intelligent automated processes (that leverage AI/ML) will be a critical enabler – they will struggle to rely on manual processes to manage increasing complexities:

- Network operations: on the network side, use cases such as network maintenance, fault detection, self-optimisation and CI/CD will be essential to manage increasing complexities – for example, telcos might need to manage network functions across multiple locations (e.g. with edge computing)

- Service operations: telcos seeking to move higher up the value chain will need to explore dynamic business models that bring in additional complexities – use cases such as customer and partner management, service provisioning and service assurance will be key enablers for this.

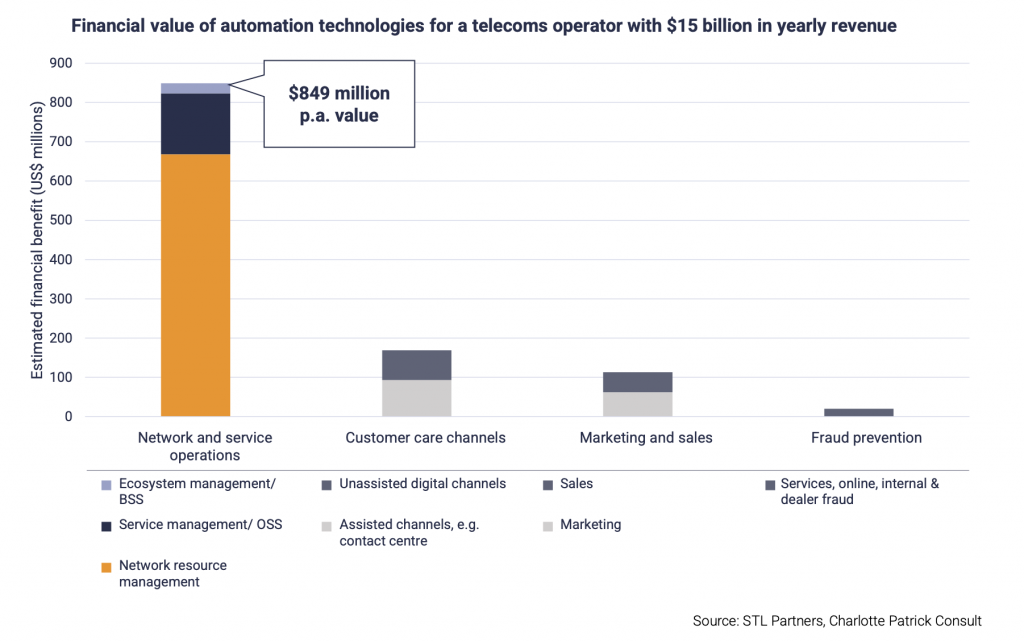

Figure 2: Automation of network and service operations could bring big financial benefits for telcos, especially compared to automation of other functions

The current state of automation in the industry

However today, most telcos are far away from deploying this level of “full automation” and are implementing specific use cases according to their unique needs (e.g. maturity, geographical or network focus). In our survey, <10% of telcos report being fully automated in any single domain within network and service operations. Automation efforts have been much more focused on non-network domains such as HR, sales, or marketing. Within network and service automation, most adoption is in use cases where vendor solutions are mature and widely available (e.g. customer billing and revenue management) compared with those that are more nascent (e.g. network function & lifecycle management).

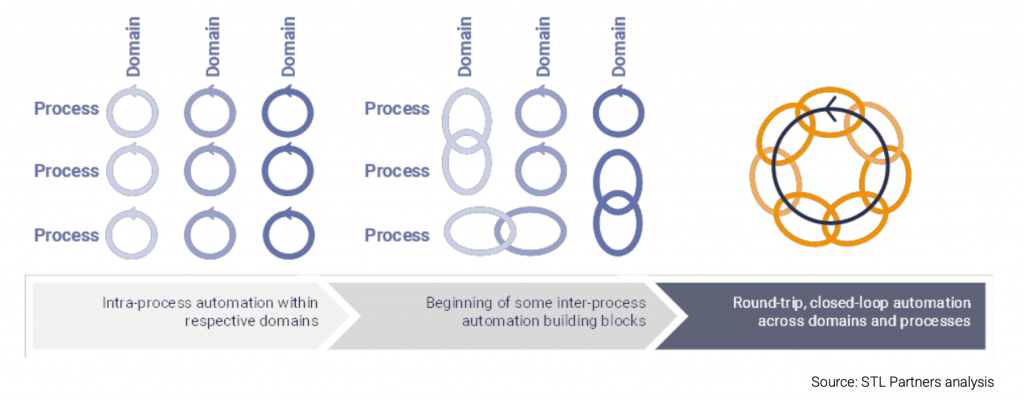

Though all telcos have some level of automation, this is mostly “intra-process” (automation of unique functions) – based on our survey, telcos on average have automated ~40% of processes within single domain use cases. To successfully compete and exploit new technologies in the long term, telcos will need to move towards “inter-process” automation (ultimately closed-loop automated processes spanning multiple domains). For example, as telcos increasingly adopt cloud-native models with microservices, it will be incredibly difficult and inefficient for all network activity to operate and be controlled separately. Network functions will require more autonomy and need to be able to communicate with each other, particularly as data from different parts of the network is brought together for more intelligent decision making (e.g. orchestration and assurance).

Figure 3: Intra-process automation will be a starting point, but telcos should begin to define their roadmap for inter-process automation

As outlined in our report, A3 for telcos: Mapping the financial value, telcos stand to save ~5.7% of their total annual revenues by automating their network and service operations. As proof points emerge and technologies mature, we expect to see more adoption of intelligent automation within the telecoms industry. Intra-process automation is an obvious starting point and an area that all telcos should be pursuing to build up the technical capabilities and expertise to support individual automation use cases, but inter-process automation should be viewed as the ultimate goal to succeed in the long-term.

Read more about Telco cloud

Telco cloud insights pack

This document will provide you with the latest insights from our research and consulting work, including some extract of our Telco Cloud Manifesto 2.0, and our latest analysis on open RAN.

Network APIs: Unlocking new value in the telco cloud

Network APIs may offer an answer to the question of how to monetise recent and upcoming telco cloud deployments. Virtualised networks upgrade APIs and enhance the value they offer to developers and customers. To unlock their potential, telcos should focus on optimising their commercial models.

Progress in telco cloud: How do we measure agility?

In the January 2023 update to our Telco Cloud Deployment Tracker, which was looking back at the entirety of calendar year 2022, we recorded an overall slowdown in deployments.

Advanced analytics for telecoms: how to unlock AI and ML capabilities

With more data than ever before, advanced analytics forms the base for AI and ML capabilities to play an essential role into the day-to-day operations of major telcos enabling smarter, more agile networks.