Edge Computing Market Trends

The global edge computing market is expected to grow rapidly at a CAGR of 34% during the period 2019-2025. We explore the main industry drivers, key players, regional differences and use case examples spanning a variety of sectors.

Global Edge Computing Market Size

Analysts, such as Allied Market Research and Market Research Future, show some discrepancies in their estimates for the size of the edge computing market. Most believe that the market will grow from close to USD 2 billion in 2017 to anywhere between USD 15 and 28 billion in 2025. For example, FiorMarkets estimates that the global edge computing market size is expected to reach USD 18.36bn by 2027, registering a CAGR of 26.5% during the forecast period 2020 – 2027. However, we expect this to be an underestimate given the growing penetration of IoT and 5G in key markets such as North America and Asia.

Overall, there is a lack of consensus with analyst forecasts in determining the actual market size of edge computing given it is still an emerging technology and use cases across different verticals have not been properly quantified. Furthermore, there is a lack of consensus in how edge computing be defined and segmented into its core components.

The global edge computing market can be segmented into these distinct segments: hardware, platform, and services. It is forecasted that the hardware segment is expected to grow the fastest between 2020-2027, registering a CAGR of over 40%. The hardware segment can be broken down into edge devices, edge gateways and servers that may reside in local data centers or at a client’s site.

Key Trends Influencing the Edge Computing Market

There are several key factors driving the growth of edge computing including the rising number of use cases requiring low-latency processing, importance of big data and the adoption of AI, IoT and the increasing number of smart devices, 5G adoption, and also partnerships and acquisitions with hyperscalers, telcos and start-ups. This article focuses on IoT growth and partnerships/acquisitions in detail.

IoT growth

IoT adoption is rapidly expanding which is causing an influx of data needing to be processed in centralised cloud computing and storage solutions. However, due to latency, bandwidth and security concerns, the viability of using the cloud is unclear and organisations are looking instead to edge computing solutions. Edge computing provides compute closer to the IoT device, for data collection and analytics. In doing so, data is more secure and network latency is reduced as the round trip to the data centre and back is shorter. As such, edge computing can optimise IoT applications, in particular ones that require real-time actions.

Partnerships and acquisitions

The edge computing ecosystem is still nascent with players from different ecosystems coming together: service providers from networks, cloud and data centre providers, traditional enterprise IT and industrial applications and systems and so on.

Hyperscalers have a strong established presence in the cloud already and have made movements towards the edge via new solutions such as Azure Stack, AWS Outposts and their IoT offerings. Start-ups including MobiledgeX, Mutable, SWIM.AI have also emerged to help provide a PaaS to help manage edge applications. Acquisitions and partnerships have been the main competitive strategies utilised by vendors in this market to gain market share and expertise.

Recent Partnerships

- Vapor IO, Federated Wireless, Linode, MobiledgeX, Packet, and StackPath launch an edge alliance to drive the adoption of edge computing.

- Litmus Automation partners with Siemens to bring IoT edge computing solutions to the manufacturing vertical.

- HPE forms a partnership and makes a strategic investment in Pensado to deliver software-defined compute, networking, storage and security services at the source of data generation.

- Verizon partner with AWS to offer 5G network edge computing using AWS Wavelength.

Regional market differences in edge computing

Our research indicates that North America is currently estimated to be the largest edge computing market, representing almost 50% of global revenue share. This finding is also consistent with the analysis undertaken by MarketsandMarkets and GrandViewResearch. The proliferation of IoT particularly in the manufacturing vertical has led to manufacturers in the US investing in connected factories the most sophisticated of which may utilise edge computing.

However, the Asia Pacific region is set to experience the highest growth rates due to increased IoT backed applications and 5G proliferation. In China, edge computing is anticipated to benefit from the rollout of 5G connectivity and other investments from the telecom industry. The Indian government, under the Digital India Initiative has pledged INR 7,000 crore for the development of 100 smart cities powered by IoT devices. In Japan, edge computing consortiums led by Mitsubishi Electric Corporation and Fanuc Corporation were formed to help develop edge computing products and unify standards.

Edge Computing Use Case Examples

Edge Computing Use Case Examples

| Industry | Use Case | Description |

|---|---|---|

| Transport and Logistics | Autonomous Vehicles | Enables autonomous platooning of truck convoys to reduce fuel costs and congestion by allowing ultra-low latency communication between vehicles. |

| Entertainment | Cloud Gaming | Supports the live streaming of games to devices with reduced latency by positioning edge servers close to gamers for a fully responsive and immersive experience. |

| Healthcare | In-hospital Patient Monitoring | Processes data locally for privacy, enabling timely notifications on patient trends through analytics/AI and providing 360-degree patient dashboards for complete visibility. |

1. Transport and Logistics– Autonomous Vehicles

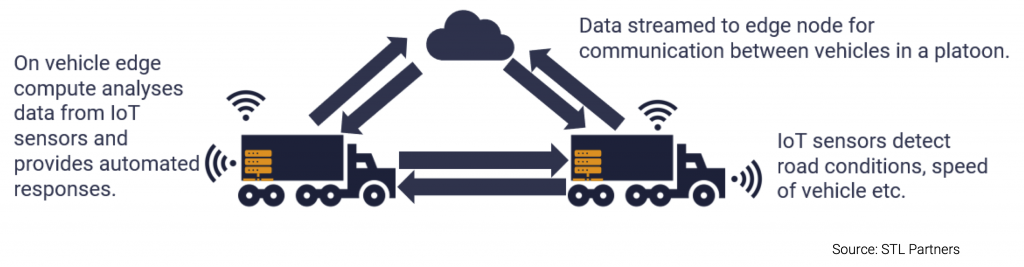

Autonomous platooning of truck convoys will likely be one of the first use cases for autonomous vehicles. Here, a group of truck travel close behind one another in a convoy, saving fuel costs and decreasing congestion. With edge computing, it will be possible to remove the need for drivers in all trucks except the front one, because the trucks will be able to communicate with each other with ultra-low latency.

2. Entertainment – Cloud Gaming

Cloud gaming, a new kind of gaming which streams a live feed of the game directly to devices, (the game itself is processed and hosted in data centres) is highly dependent on latency. Cloud gaming companies are looking to build edge servers as close to gamers as possible to reduce latency and provide a fully responsive and immersive gaming experience.

3. Healthcare – In-hospital Patient Monitoring

Healthcare contains several edge opportunities. Currently, monitoring devices (e.g. glucose monitors, health tools and other sensors) are either not connected, or where they are, large amounts of unprocessed data from devices would need to be stored on a 3rd party cloud. This presents security concerns for healthcare providers.

An edge on the hospital site could process data locally to maintain data privacy. Edge also enables right-time notifications to practitioners of unusual patient trends or behaviors (through analytics/AI), and creation of 360-degree view patient dashboards for full visibility.

Read more about edge computing

Edge computing market overview

This 33-page document will provide you with a summary of our insights from our edge computing research and consulting work:

What does IPCEI CIS tell us about the future of edge and cloud in Europe?

We discuss this EU-funded initiative’s pivotal role in advancing interoperability, sustainability, and cybersecurity, as industry giants like Orange, SAP, and Deutsche Telekom collaborate to shape Europe’s tech trajectory.

Accelerating the network: Lessons from Lumen and SK Telecom

STL Partners has conducted extensive research on telcos globally, focusing on their edge computing deployments. STL’s report “Telco network edge computing: Lessons from early movers” delves into the experiences of Lumen, SK Telecom, Telefónica, Verizon, and Vodafone, all of which commercialised edge nodes before 2020. This article highlights key findings and four crucial insights gleaned from these early telco-edge movers.

15 Edge AI Companies: Independent Software Vendors (ISVs) to watch in 2024

STL Partners look at 15 Independent Software Vendors (ISVs) that are using edge computing technology to ensure maximal performance and reliability in their AI models.