Edge computing investments in 2021

In 2020, STL Partners hosted a webinar and wrote an article looking at edge computing investments in 2019. This article analyses edge investments since then: which trends have continued and which new ones are starting to emerge.

Our last edge investment update

In March 2020 STL Partners conducted an analysis of edge computing investments from January 2019 to February 2020. The main finding was that investment levels remained low despite the increased hype for the technology. The article looked at the 30 companies in our Edge Computing Ecosystem Tool which were split out into 7 categories:

1. Facility: The physical site that includes the land/location for the edge data centre, the data centre itself, power and cooling to support it and additional services to maintain and operate the site.

2. Network: Connectivity infrastructure to and from the edge site, as well as traffic routing controls and types of networks to optimise the delivery of content (e.g. CDN).

3. Hardware: This includes the hardware inside the data centre (racks, servers, processors and the maintenance and operators for these) as well as end-devices.

4. Cloud Infrastructure: Virtual infrastructure supporting the edge workloads and applications, from the operating system, the virtualisation layer (which may be container-based), and the platforms for developers to access and manage the storage and compute infrastructure.

5. Application/Software: Applications that run on edge computing infrastructure, including network functions, and the application-specific tools that support these, for example analytics capabilities or APIs and platform-as-a-service products.

6. Integration & Services: Services that provide support to the customer employing and integrating edge computing at any stage of the value chain – including design and engineering services to create platforms for edge computing applications, or more traditional integration into existing (enterprise) systems.

7. Open Source & Forums: Communities that seek to accelerate edge computing – either by creating forums for discussion across stakeholders and industry partners or open platforms to enable developers to build technology.

The total amount invested during this period was $3.1 billion, with the majority of this going to firms in the Facility category. At that time, we predicted a continued rise in investments in data centre facilities and other parts of the value chain driven by:

1. VCs and private equity (PE) and other investment firms (e.g. infrastructure funds);

2. Hyperscalers looking to exploit the physical locations of telecoms operators (and others);

3. Tech companies;

4. Telecoms operators themselves looking to build positions beyond basic infrastructure.

Edge computing investments in 2020/21

Since our last update we have continued to track investments in the edge computing space. We have tracked investments of over $3m from a single transaction across the different areas above (as before Open Source & Forums has been excluded as it does not attract much investment).

Data centre investments have driven edge investments

Figure 1: Edge investments have remained dominated by Facility

As Figure 1 shows, Facility investments still dominate: total edge investments in the period were $13.95bn with over $12bn coming in the Facility segment. This was driven by a number of large M&A deals in the data centre space. The maturity of this foundational infrastructure is further illustrated by the significant investments coming from Private Equity firms who tend to seek mature companies with stable cash returns in which to invest.

It is interesting to note that Facilities made up nearly $1.5bn of the $3.1bn total invested in the 30 companies tracked previously (around 48%) but this has now risen to 86% of total investments. The first step of investment at the edge was always likely to come at the Facility level – the physical edge must be built out before it can be filled – so it is unsurprising to see the trend continue.

Facility can, however, be a difficult category to track for several reasons:

• It can be hard to segment investments in much larger data centre facilities (which are not really at the edge) from those at smaller facilities.

• There are many acquisitions within the data centre market from one data centre firm acquiring another, this may therefore not be new investment in the edge ecosystem but rather cash being swapped in by an alternate player.

• Many acquisitions such as these are for undisclosed amounts.

• There will be organic investment by regional data centre companies around the world that is hard to capture.

To understand how the edge market is developing it is, therefore, worth examining investments in the other segments in a little more detail.

Edge computing has seen an overall increase in investment in other areas

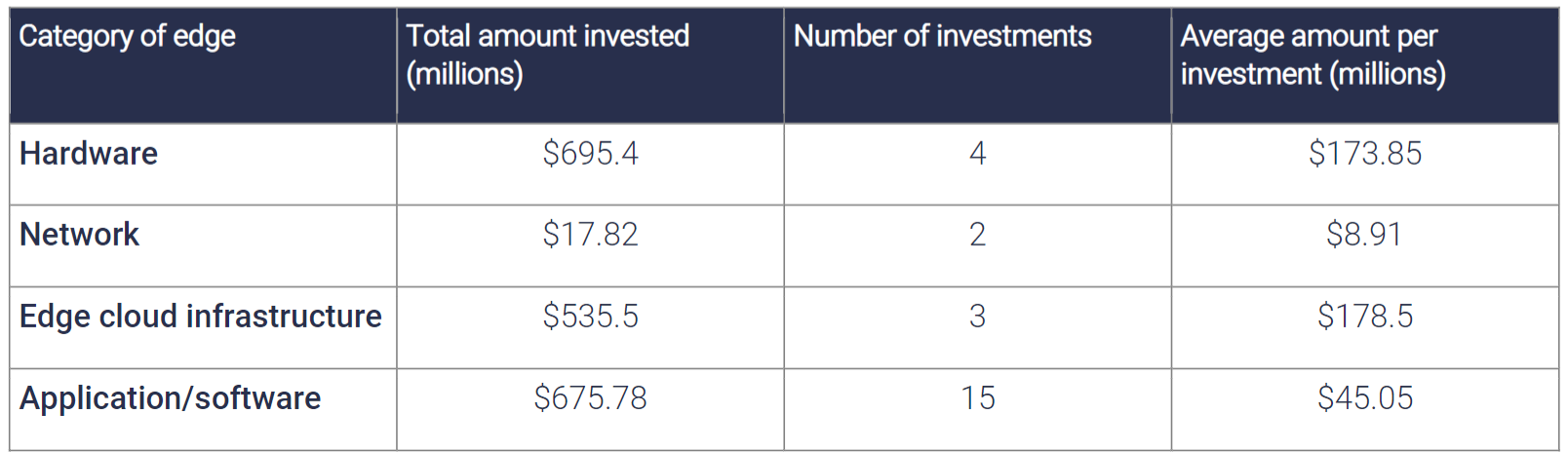

Figure 2: Edge investments have been similar across Hardware, Edge cloud infrastructure and Application/software

Source: STL Partners

Note: Systems Integration tends to be OPEX-based and grow after the market has reached greater maturity, it therefore did not see any investment in the past year and has been excluded.

Investments in Hardware, Edge cloud infrastructure, and Application/software have been at a similar level. Network only saw a small amount of investment. The total amount invested in these 4 categories totalled over $1.9bn, which is 20% bigger than the $1.6bn invested in the previous period we analysed.

81% of investments in this time period were conducted as part of venture capital rounds. This is evidence that investments are still in their early stage for companies in these edge segments. The more mature Facility segment was seeing large M&A activity driven by large players in the market, whereas the less mature segments are still looking to VCs to fund their growth.

Application/software companies are less mature than in other segments

As well as Facility, to actually build out the physical edge Hardware, Network and Edge cloud infrastructure all require a level of investment. We would then expect investment in the applications which sit on top of this infrastructure. It is therefore unsurprising to see that Application/software received only slightly less investment than Hardware, and more investment than both Network and Edge cloud infrastructure. Without applications there is no justification for building the infrastructure that they will run on. Investment in applications therefore follows closely any investment in infrastructure.

Source: STL Partners

As clearly visible in the above table, while Application/software had a greater total amount invested than Edge cloud infrastructure, the average amount invested per investment was almost 4 times larger for Edge cloud infrastructure. This speaks to the nature of hardware vs software. Hardware, Network and Edge cloud infrastructure require lots of capital whereas Application/software require less. You tend to get larger infrastructure players (owing to economies of scale) and smaller independent software vendors (ISVs) that are easier to set up and serving more niche markets. This is why each individual investment in applications is likely to be smaller, there are lots of companies receiving investment to create an ecosystem. The numbers therefore show the early signs of a vibrant applications ecosystem developing.

This may also suggest that the applications are at earlier funding rounds than Hardware, Network, and Edge cloud infrastructure. This reflects what we might expect: as the edge is still being built out the more mature firms are at the Hardware and Edge cloud infrastructure level than at the Application/Software level where start-ups are receiving initial rounds of funding. As the edge matures these application providers will begin to see bigger investments in future rounds of capital funding.

Why is Network investment low?

It is surprising to see that Network investment is so much lower than investment in the other areas – in our last analysis Network attracted $306m of investment. Even controlling for the number of investments we see that the average is below Application/software. There are a couple of possible explanations for this:

• Given the small sample size we would expect a high level of variance with any results. Just 1 or 2 large investments would raise both the average and total amount invested to a level that we would expect.

• Telcos are beginning to invest more in their own network edge and this is crowding out investment to other players. Most of the investment in networks will be made organically by the big telcos, we are therefore less likely to see much external investment unless the private networking space takes off and new players enter that market.

• The companies in the Network segment are reaching maturity as the physical edge is built out further. This similarly seems unlikely given we do not see a similar trend in Hardware and Edge cloud infrastructure.

We can safely assume that the fall in investment in the Network segment is due to a combination of year-on-year natural variation and organic telco investment crowding out the market.

More predictions for edge computing investments

We expect edge computing investments to continue accelerating year-on-year for the foreseeable future as we are still in the early stages of the growth curve. As the market matures and applications start to generate returns from enterprises it is natural for investment to grow throughout the stack.

However, we would also expect the composition of this investment to continue to change. The Facility segment will likely remain the largest area of investment in the short term, these are large infrastructures that take advantage of economies of scale and need large amounts of capital. However, we would expect to see investment in this area plateau somewhat in the medium term in markets where the edge becomes closer to full build out. Hardware, Network and Edge cloud infrastructure are likely to follow a similar trend to Facility, albeit at lower overall levels of investment. We would expect investment in Applications/software to continue to grow as the edge market matures. Once the edge has been fully built out, the number of applications that can be run does not cease to grow so we would therefore expect to see investment in Applications/software to grow long after the other segments plateau. The size of the investments in this segment should also grow as companies mature and reach later funding rounds.

In the short and medium term we would expect investment to continue from the venture capital community before larger investment funds and PE houses enter the market in earnest. As highlighted in our previous article we also expect investment to come from other groups, namely hyperscalers and tech companies. Hyperscalers are already investing massively in their edge strategies and we would expect them to look at acquiring Application/software companies as they mature. Telecoms operators will also invest as they look to move beyond pure connectivity.

Read more about edge computing

Edge computing market overview

This 33-page document will provide you with a summary of our insights from our edge computing research and consulting work:

8 edge computing pricing models

Customers are in the process of learning about edge computing and its benefits. However, a key component of their decision-making process is how to pay for the edge. In the article, we outline potential pricing models for accessing edge computing.

What is telco federated edge?

The idea of federating the telco edge has been around for some time and there is strong operator interest in pursuing this opportunity. However, it’s yet to be seen how federation will work in practice. This article is our take on answering some of the open questions on this topic.

5 things edge computing app developers want telecoms operators to know

The telecommunications industry interested in edge computing must listen to the requirements of developers who will run their applications at the edge. These developers want clarity around delivery, orchestration and pricing.