Fixed-Mobile Convergence: More than just discounting?

Whilst the concept of Fixed-Mobile Convergence has been around for over a decade, we have noticed a renewed emergence in recent years. Within this article, we will categorise the varying benefits that are unlocked by convergence and examine some examples where Telecom operators are moving beyond the current narrative and offering consumers more attractive benefits than simply just the traditional discounting.

Current State of the Fixed-Mobile Convergence Market

The adoption of Fixed-Mobile Convergence (FMC), the merging of fixed and mobile telecom services to provide a seamless connectivity experience for the consumer, is a concept that has now been around for the over a decade. Historically, this move has been driven primarily in Europe and North America with limited FMC take-up in the rest in the world. However, there has been significant growth in the adoption of FMC services in the past two years as Telco’s look at ways to secure and grow revenue streams.

So far, convergence has helped telecom operators evolve their portfolios into adjacent services/markets and provide multiple offerings to consumers to drive revenue and efficiency improvements as well as reduce churn. These market strategies have been achieved through dual network ownership, through M&A or also through the wholesale model. However primarily, network operators have pursued FMC strategies through M&A to preserve revenue and realise cost related synergies with European operators among the most active in mergers over the past decade.

Figure 1: Recent timeline of European Fixed-Mobile Convergence mergers

Incentives as part of Fixed-Mobile Convergence strategies

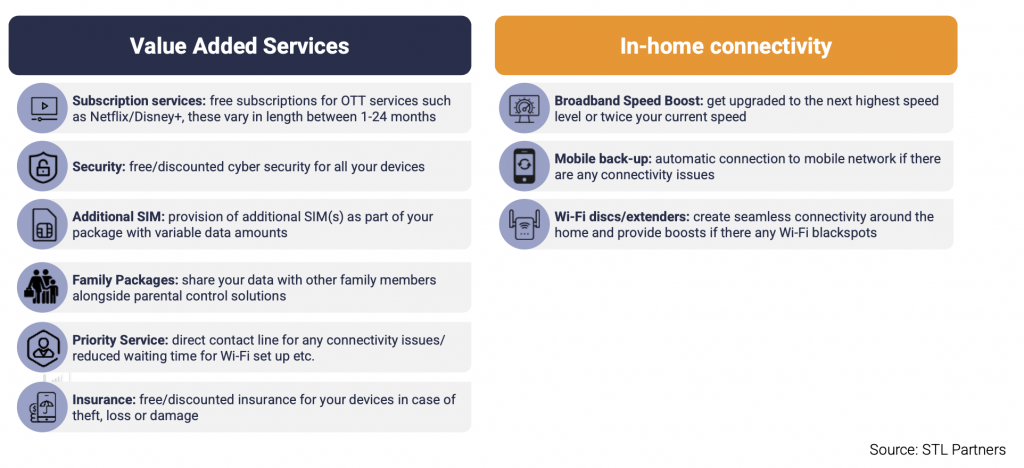

Operators promote a range of incentives to drive FMC adoption and take-up of multiple services. STL Partners identified four clear categories of benefits/services that telecom operators utilise as incentives to promote their converged packages:

- Discounts

- Additional mobile data

- Value Added Services e.g., OTT apps, priority service, security, insurance, additional SIMs, family packages

- In home connectivity e.g., BB speed boost, mobile back-up, Wi-Fi boosters

Figure 2: Telecom operators offer several benefits to consumers taking bundled packages

Historically, FMC policies have been synonymous with heavy discounting with Telecom operators pursuing aggressive pricing strategies to ensure rapid customer growth. These are often offered alongside the provision of additional mobile data (unlimited/double) which comes at minimal cost to the operator. Discounted services are typically value destructive as they reduce potential revenues, offer limited benefits to the end user, and fail to take advantage of any connectivity benefits that have been unlocked through the converged package offering.

Moving beyond discounting and towards offering unique benefits and value orientated propositions is therefore critical to maintain differentiation and to secure a positive incremental margin.

Figure 3: Convergence should be seen as a source of differentiation for Telecom operator

Fixed-Mobile Convergence Price premium model approach

Several operators are now shifting towards providing bundles that enhance the customer experience and/or broaden the scope of services. The evolution of technology is also further making ‘true technical’ convergence a reality, as operators start using convergence to extract a price premium by offering strong incremental benefits vs stand-alone props.

We explore three case studies where network operators have adopted strategies that focus on a price premium model over discounting.

1. BT/EE, UK

BT’s premium broadband offering, BT Halo comes with added mobile convergence benefits.

It was the first network operator in the UK to launch a fixed offering that’s backed up by mobile to alleviate any connectivity issues and includes the following benefits:

- BT’s gateway hub is integrated with a 4G SIM connection providing customers with a mobile connectivity back-up should there be any issues with the customers fibre connection.

- Customers receive up to three free Wi-Fi discs (Wi-Fi boosters) to alleviate Wi-Fi blackspots in the home with a £100 money-back guarantee if they are unable to provide reliable Wi-Fi in every room.

- In-home support which includes the ability to book home tech experts, seven days a week in 2-hour time slots in case of connectivity issues.

Customers who also add mobile alongside their fixed package receive the standard discount and double mobile data that is commonplace amongst traditional FMC packages.

Figure 4: BT Halo proposition provides hybrid connectivity benefits for consumers from BT and EE

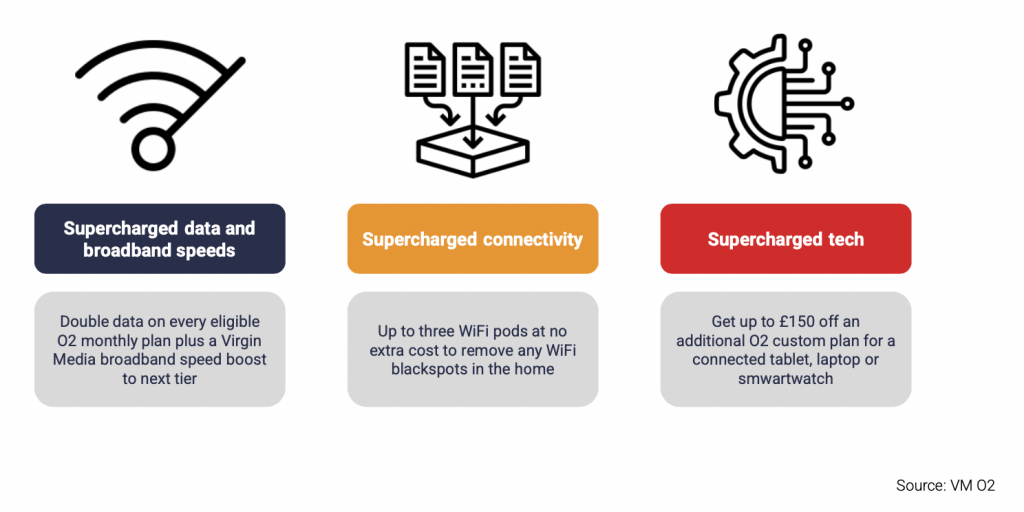

2. Virgin Media O2, UK

Following their merger in June 2021, Virgin Media O2 launched their combined VOLT offering which gives customers convergence benefits at a price premium in contrast to the typical discounted bundles so often associated with FMC packages. Similar to BT, Virgin Media O2 provide up to three free Wi-Fi pods which provide enhanced coverage in the home especially where there are Wi-Fi blackspots. However, within their packages they also provide the following additional benefits:

- Customers receive up to £150 off a second device such as a connected tablet, laptop, or smartwatch

- Double data on every mobile plan

- Broadband speed boost which gives customers an upgrade to the next highest speed tier (if they are not already on the fastest speed they can get at their home/location)

Figure 5: VM/O2’s FMC offering provides several benefits for consumers

3. Telenet, Belgium

Telenet in Belgium adopted a decisive strategy to ensure increased take up of their converged packages by actively restricting the range of stand-alone BB and mobile packages to proactively drive FMC take-up, at a price premium. The operator’s stand-alone ‘unlimited’ packages come with significant data restrictions with maximum capped download and uploads speeds as seen with their Unlimited Internet package. In contrast, Telenet’s converged One Up package includes no such restrictions with download speeds up to 1 Gigabit per second at home and unlimited giga-speed surfing at a price premium.

Figure 6: Comparison between Telenet’s Unlimited WiFi and One Up package

Download this article as a PDF

Read more about consumer services

Consumer insights pack

This document will provide you with a summary of our insights from our consumer services work

What is smart Wi-Fi?

Smart Wi-Fi refers to the use of capabilities in the Wi-Fi system that enhances the network service (reliability, availability and latency).

What is GCash?

In this article, we explore some of the reasons why GCash has become so successful and the ongoing challenges they will face.

Augmented reality use cases: Unlocking consumer experiences

This article examines the impact of AR in two key consumer domains – live events and commerce – and judges where telcos fit in.