What does telco cloud mean for different telco stakeholders?

Telco cloud will be a key enabler in the Coordination Age, but the role and value it provides is different depending on the stakeholder group within the organisations. We explore the different opportunities and concerns for telco cloud for various stakeholders across telecoms organisations.

Embracing telco cloud

Telco cloud and cloud native networking fundamentally change what it means to be an operator in the Coordination Age. This is not just about a technology evolution but a wider business transformation and driver of future telecoms growth. You can read more about this in our recently published Telco Cloud Manifesto.

In this article, we look at what telco cloud means for different stakeholder groups within telco operators, including how telco cloud can address their main challenges and ambitions, and how telco cloud can enable greater cross-company innovation and collaboration.

The exact influence, structure and organisation of these teams will vary between telcos, but broadly speaking, stakeholders within the groups above will be looking to telco cloud as a way of driving greater agility, efficiencies and/or revenue growth beyond connectivity.

Unique stakeholder journeys

Cost-saving and efficiency improvements will be key priorities for stakeholders in every group, but many telcos are also making a strong push to find new opportunities for (revenue) growth. Successful, scaled innovation will require a cross-company drive to enable differentiated products and services, but stakeholders will have different concerns that could hinder adoption.

As telcos move towards cloud-native networking (e.g. with 5G) and seek to exploit the benefits of emerging technologies such as edge computing, providing greater API exposure in a secure way will be important to make more network insights available for ecosystem partners and customers. This is key to providing a means of differentiation for both the network and applications that run on top. The enhanced visibility between applications and network and network programmability will make it easier for applications to “instruct” the network to optimise services and flexibly allocate resources to achieve certain performance outcomes (e.g. low latency, high bandwidth). For example, the ability to accommodate for surges in demand and ensure a consistent quality of service for the end user for applications such as cloud gaming, video streaming services.

But, while the overarching vision and drive to expand the (B2B) portfolio with differentiated applications and services might be set by commercial/strategic stakeholders, pushing this innovation will require collaboration with more network-focused teams who will have a different set of challenges to consider. Teams that are more traditionally focused on the network may be focused on how telco cloud affects their operating model and how they can manage the move to more agile practices to service innovation (e.g. DevOps, CI/CD pipelines).

Unique stakeholder journeys

Cost-saving and efficiency improvements will be key priorities for stakeholders in every group, but many telcos are also making a strong push to find new opportunities for (revenue) growth. Successful, scaled innovation will require a cross-company drive to enable differentiated products and services, but stakeholders will have different concerns that could hinder adoption.

As telcos move towards cloud-native networking (e.g. with 5G) and seek to exploit the benefits of emerging technologies such as edge computing, providing greater API exposure in a secure way will be important to make more network insights available for ecosystem partners and customers. This is key to providing a means of differentiation for both the network and applications that run on top. The enhanced visibility between applications and network and network programmability will make it easier for applications to “instruct” the network to optimise services and flexibly allocate resources to achieve certain performance outcomes (e.g. low latency, high bandwidth). For example, the ability to accommodate for surges in demand and ensure a consistent quality of service for the end user for applications such as cloud gaming, video streaming services.

But, while the overarching vision and drive to expand the (B2B) portfolio with differentiated applications and services might be set by commercial/strategic stakeholders, pushing this innovation will require collaboration with more network-focused teams who will have a different set of challenges to consider. Teams that are more traditionally focused on the network may be focused on how telco cloud affects their operating model and how they can manage the move to more agile practices to service innovation (e.g. DevOps, CI/CD pipelines).

Commercial and Strategy

Stakeholders within the commercial or strategic teams will be primarily focused on product/service innovation and differentiation. This could mean looking at ways to:

- Enhance and expand their portfolio of products and services

- Support ecosystem partners (e.g. application providers) to provide differentiated services on top of their network

Their ambitions will therefore likely centre around how they can create greater value within the ecosystems they participate in, but they may also be grappling with pushing agile transformation initiatives internally to fundamentally change the way that they innovate to become more software-centric businesses.

Generally, commercial teams will be looking at how they can provide greater differentiation, whether that be through a more tightly-coupled relationship between applications and the network, or otherwise. However, given this resurgence in interest in having applications interface much more with the network, being driven by 5G, edge computing and the move to cloud-native technologies, we see this as a key opportunity for telcos moving forwards in being able to provide unique value.

Network Operations

The major concern for operations teams is to ensure the stability, reliability and resilience of the network. This means minimising any risks (e.g. that could cause outages), ensuring strong customer experience, and being able to remedy any issues quickly and easily. Reducing costs are also of particular concern as network downtimes can be hugely disruptive and expensive.

These concerns mean that operations teams may be more reluctant to make big changes to their existing processes and systems, but they can hugely benefit from a more automated network. Network automation (including Day 2 services) can give telcos the ubiquitous ability to monitor, optimise and modify systems, enabling performance at scale, with systems that work as intended, even as demands on the network grow (e.g. new applications and services).

Technology and Network Strategy

Stakeholders within network technology or CTO teams will largely be seeking to expand their network (cost) efficiently, how they can drive greater innovation within the network in an agile way and will be exploring how they can implement and capitalise on new technologies (e.g. 5G and edge computing).

In order to maximise the benefits of telco cloud, network teams must not only adopt a cost-driven approach, but also focus on the opportunity to drive greater revenue, and be open to working with other internal stakeholders to enable new growth opportunities. This will mean a new fundamental way of operating, such as adopting DevOps practices and CI/CD pipelines for more agile development. This will enable telcos to go-to-market much quicker with new products and services.

As networks become increasingly accessible and programmable, the technology teams will play an increasingly important role in understanding how to expose and provide greater network intelligence, insights and “instructibility” to not only partners (e.g. application developers) and customers, but also internal teams and stakeholders (e.g. IoT unit).

Read more about Telco cloud

Telco cloud insights pack

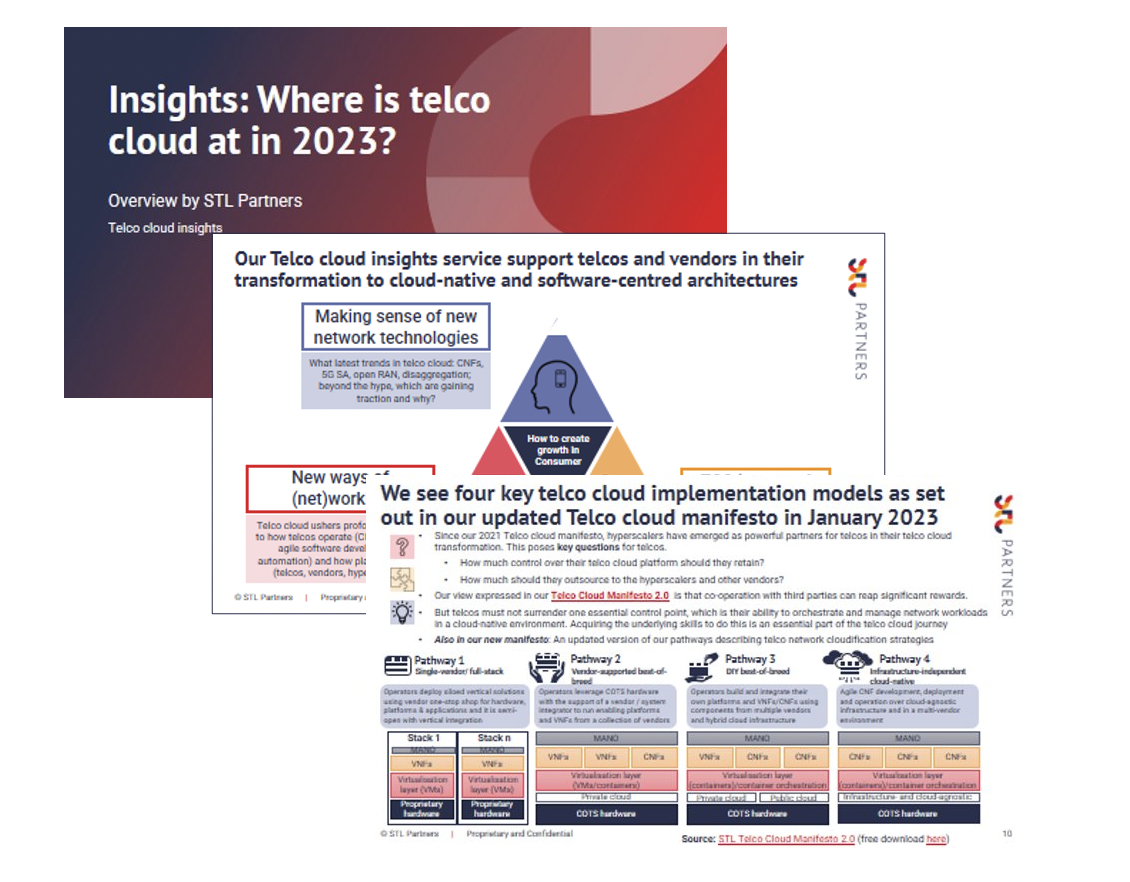

This document will provide you with the latest insights from our research and consulting work, including some extract of our Telco Cloud Manifesto 2.0, and our latest analysis on open RAN.

Network APIs: Unlocking new value in the telco cloud

Network APIs may offer an answer to the question of how to monetise recent and upcoming telco cloud deployments. Virtualised networks upgrade APIs and enhance the value they offer to developers and customers. To unlock their potential, telcos should focus on optimising their commercial models.

Progress in telco cloud: How do we measure agility?

In the January 2023 update to our Telco Cloud Deployment Tracker, which was looking back at the entirety of calendar year 2022, we recorded an overall slowdown in deployments.

Network Innovation insights pack

This document will provide you with the latest insights from our research and consulting work, including some extract of our Telco Cloud Manifesto 2.0, our latest analysis on open RAN.