Case study overview

New opportunities mean our clients explore new markets beyond traditional telecoms. To support them, we conduct primary research with suppliers and customers, to better understand the ecosystem and how it is developing. STL consultants are also skilled at sizing market opportunities and identifying the most attractive options for our clients.

Below we outline how we helped a global operator to:

- Understand the drivers of the connected car market;

- Calculate the addressable market, including potential revenues and operational metrics.

Consulting services overview

Get in touch to find out how we can help you:

- Analyse market trends and dynamics

- Conduct market sizing and forecasting

- Prioritise initiatives for new growth

Understanding the trends and dynamics in the connected car market

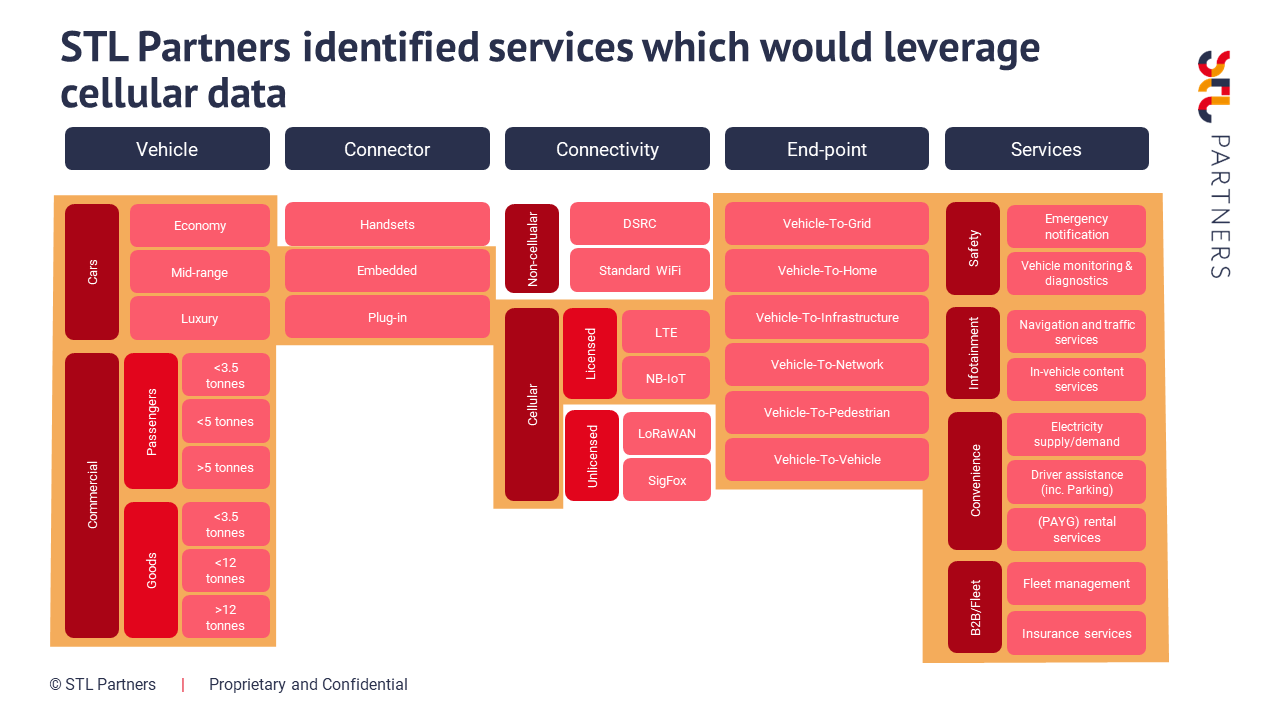

We conducted in-depth research, including interviews with OEMs and connected car solutions providers, to define and assess:

The key services being delivered in a “connected car” model (e.g. navigation and traffic services, infotainment, and so forth);

- How this varied by vehicle type (e.g. economy, mid-range, and luxury cars);

- How this varied by country and region (e.g. across the client’s key markets);

- How this varied over time (e.g. deployment and roll-out of new use cases).

Example deliverables

Example deliverables

Calculating the addressable market

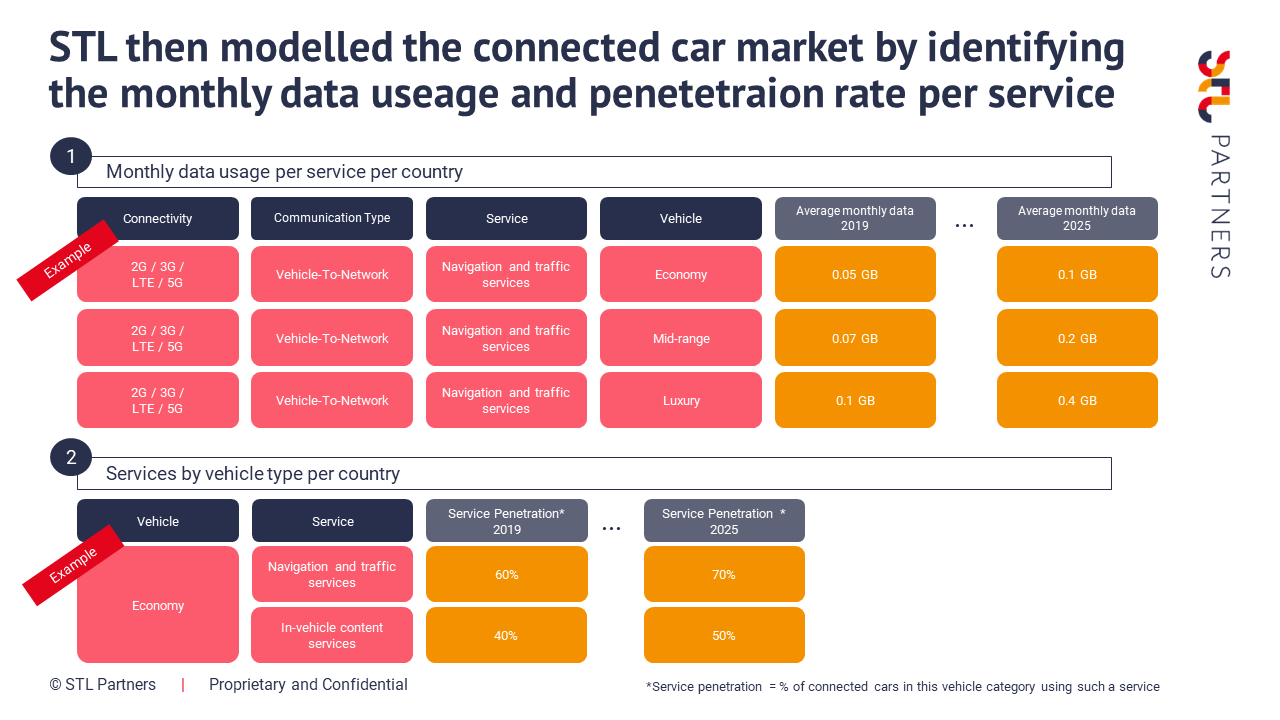

Once we had defined the viable services being delivered over-the-air to a connected car, we developed a bottom-up model to quantify the:

- Number of connected car units globally;

- Annual and monthly data volumes from connected cars;

- Annual and monthly revenues derived from connectivity;

We did this by building and validating assumptions for data volumes per service per month, service penetration by market over time, and the price of data across different regions.