1 Drillisch AG: forging ahead with Open RAN

The greenfield German telecoms operator 1&1 Drillisch AG announced plans to speed up the deployment of its own Open RAN technology, aiming to provide at least 1,000 5G base stations by 2022. But it will probably take until the beginning of 2023 before the network can go live and existing customers can be migrated to its own infrastructure.

Open RAN still waiting to ramp up

In recent years, operators across the globe such as Vodafone, Turkcell, Telefonica have made announcements about their progress in deploying open RAN, but much of this progress is still at the relatively early stages.

Our analysis of the market to date indicates that it is still early days for open RAN and even virtualised RAN in terms of live deployments. Although there was a flurry of activity in 2020 for open RAN with small scale trials, some of which continued to carry live traffic, that has seen a slower period in 2021. Focus on trials, integration, operational models and other key aspects has meant that there was a lack of commercial deployments in 2021. However, significant potential progress and planned deployments are expected in 2022 not only from 1&1 but also from the likes of DISH, Verizon, Vodafone UK, MTN and others.

We dive into more detail and analysis in the latest update to our Telco Cloud Deployment Tracker, see our accompanying report here ‘Telco Cloud Deployment Tracker: Open RAN deep dive’.

A greenfield opportunity

1&1 Drillisch AG is a German telecommunications service provider has set its eyes on becoming Germany’s fourth mobile network operator. The firm is 75% owned by United Internet and already has 10 million customers, and provides both mobile and broadband services, via leasing agreements with Telefonica Germany (O2), Vodafone Germany and other network service providers.

1&1 acquired 5G spectrum in 2019 as part of its pledge to become a fully-fledged mobile network operator. The operator is now committed to building out its own nationwide fully virtualised greenfield 5G network using Open RAN technology. By doing so, it will become the first European operator to commit to building a complete Open RAN-based network and add fuel to the growing fire raging under the Open RAN sector.

1&1 has established goals of building 1,000 sites by the end of 2022 and serving at least 25% of the German population by 2025 and 50% by 2030 with its greenfield network. These goals are part of its commitments made as part of its agreement with the government when it purchased needed 5G spectrum, which it hopes to accelerate and exceed according to CEO of 1&1’s parent company United Internet.

A collaborative approach

Rakuten Communications Platform (RCP) to play key role

1&1 is working with Rakuten and NEC to build out the new network and plans at least $10 billion in investment this decade. According to 1&1, Rakuten will take over the installation of the active network equipment and will also be responsible for the overall performance of the 1&1 mobile network. It will make use of the spectrum 1&1 acquired for just more than €1 billion in mid-2019, namely two frequency blocks of 5 MHz in the 2 GHz band and five frequency blocks of 10 MHz in the 3.6 GHz band.

1&1 will leverage the Rakuten Communications Platform (RCP) with its access, core, cloud and operational solutions as well as Rakuten’s partner network. In this context, Rakuten will also provide its own developed orchestration software so that the 1&1 network can be operated in a highly automated manner. Rakuten says its technology offers flexibility and lower costs, including up to 30% cheaper operational costs than with traditional networks.

Learning from previous experience for speed

Michael Martin, CEO of 1&1 Drillisch, is confident that Rakuten Symphony can leverage its experience in deploying open RAN in its own network in Japan for Rakuten Mobile and ‘take the learnings into [their] Germany Open RAN 2.0 network’. This not only includes the deployment but also the ongoing operational aspects with greater use of automation and analytics for more intelligent networking.

AT&T is using part of Rakuten’s cloud-based network solutions to design and simplify network deployments. But 1&1 is the only company that has signed a greenfield deal to build a network from scratch with Rakuten Symphony, the Amin-led enterprise to sell Rakuten’s technology internationally.

“1&1 is going to build a network in Germany that I think is going to be superior architecturally to what exists in the marketplace today.”

Tareq Amin, CEO, Rakuten Symphony & Group CTO, Rakuten Group

With Rakuten’s capabilities, experience and acquisitions of Altiostar and more recently Robin.io, the partnership ultimately enables 1&1 to step up to the challenge to compete with the likes of Deutsche Telekom, Vodafone Germany and Telefonica Germany.

For more information on our analysis of Rakuten in the wider industry context, see our recent report, Why and how to go telco cloud native: AT&T, DISH and Rakuten.

Telco Network Energy Efficiency: The Role of the RAN in Future Energy Consumption

With sustainability increasingly front of mind for stakeholders, operators are looking to the RAN for energy saving solutions to support their journey to net zero. This article details both the need for such solutions and what is on offer in the current marketplace.

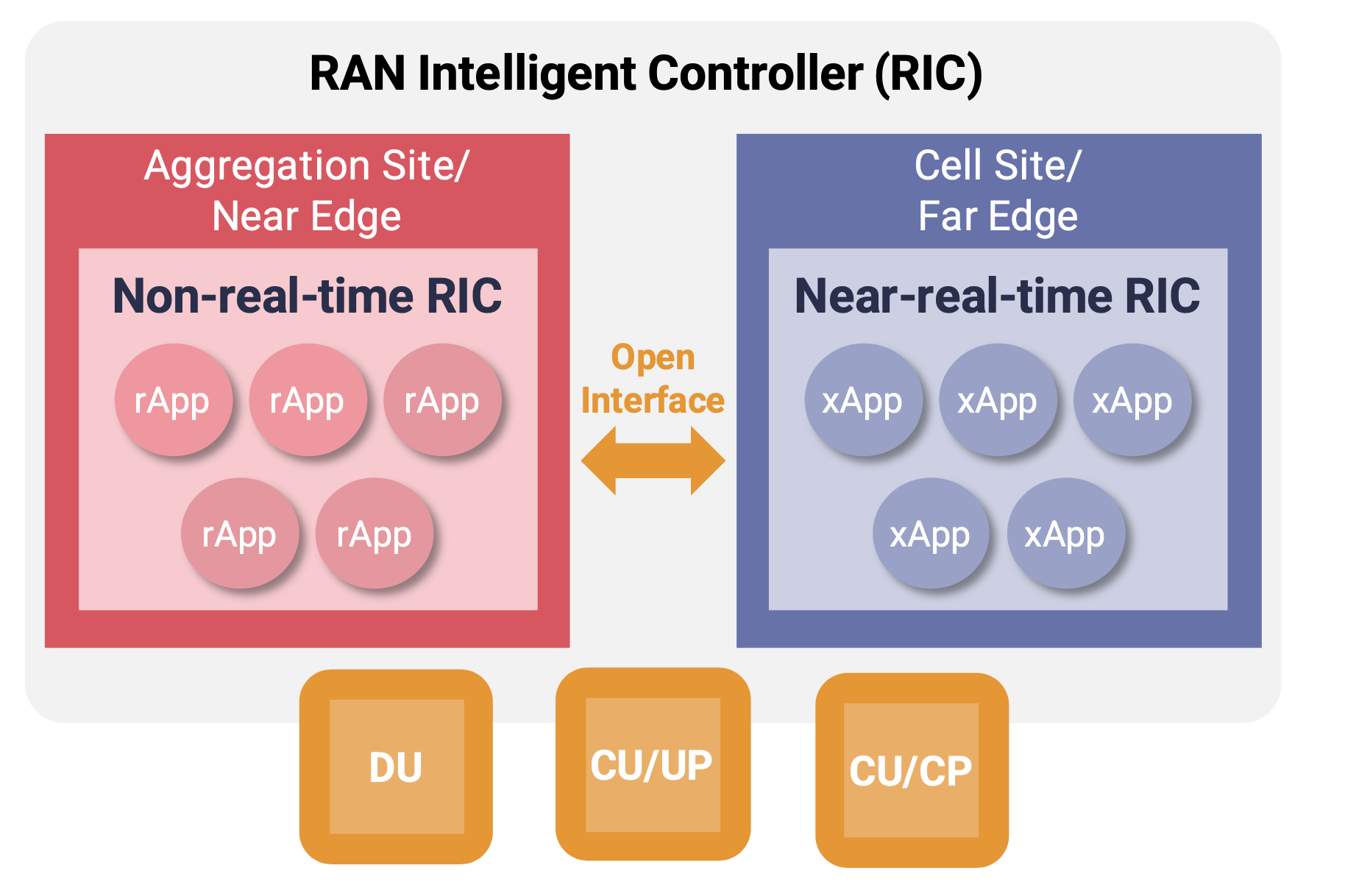

What is the RIC, and why should CSPs care?

As CSPs move towards O-RAN, the RAN Intelligent Controller (RIC) will be a key component in enabling transformation. In this article we explore what the RIC is, how far along the industry is with adoption, and how the RIC will benefit CSPs.

RIC, xApps, rApps: A Comprehensive Guide to the Key Players

As the radio access network continues to evolve towards more open architecture, opportunities for innovation in the Open RAN space have proliferated. One of the central components within Open RAN architecture is the RAN Intelligent Controller (RIC), which provides an open hosting platform for innovative xApps and rApps. We highlight 12 key players in this space.