Building a telco edge infrastructure: MEC, Private LTE and vRAN (chart)

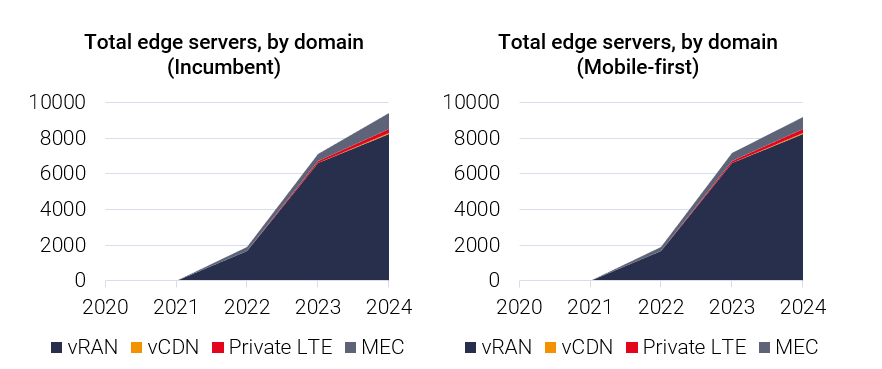

We predict a Tier-1 operator will have more than 8,000 edge servers by 2025, supporting edge workloads across multiple domains.

vRAN is unique among the use-cases we have modelled because it is an evolution of a core service. Private LTE, vCDN and MEC all involve connectivity, but represent new service offerings, for which the operator must attract new, primarily enterprise customers (or convert existing customers), with the hope of extracting new revenues. Building a customer base will take time and investment. vRAN, however, is more of an efficiency upgrade to mobile networks which already exist and support millions of subscribers. As soon as it goes live, it will have users.

For this reason, the amount of infrastructure required to support vRAN within our five-year timeframe – for both our converged and mobile-first operators – is several orders of magnitude larger than the other use-cases. Approximately 80% of edge servers in use by operators in 2024 will be supporting vRAN workloads.

The curve for adoption of vRAN shown in these charts is fairly steep – suggesting that operators will move fast to adopt it over the coming five years. In fact, our model assumes that by 2024, both of our operators will have virtualised 100% of their existing LTE (4G) baseband functions – corresponding to around 16,500 mobile base stations. This may seem ambitious, but it is very much in line with what the roadmap outlined by Western European operators. The reason we believe this roadmap to be realistic is two-fold:

- vRAN is already being deployed in test environments – and based on approaches we have seen for other VNF deployments, we believe operators will scale as soon as it is proven

-

- The handful of physical sites required to host the centralised vRAN workloads actually already exist (or at least are in the process of being built). These same sites are being used to support operators’ ongoing programme to distribute user plane functions that currently sit in the core network closer to end-user – so the case for investment and process of building new infrastructure has already been made.

See our in depth research on MEC, private LTE and vRAN

Download this article as a PDF

Read more about private networks

Private networks insights pack

Our pack will provide you with a summary of insights from our private cellular networks practice

The private 5G edge opportunity: a deep dive on three use cases

We spoke to five innovative ISVs working within three use cases which we feel will drive deployments of the private 5G edge.

What are the enterprise customer journeys for adopting private networks and edge?

We have been speaking to enterprise customers to try and understand distinct customer journeys to adopting private networks & edge computing.

Telcos see private cellular and edge as two peas in a pod

Telecoms operators see private cellular and edge computing as part of a larger revenue opportunity beyond fixed and public cellular.